President Macron’s decision to call a snap election has had a dramatic effect on bond and equity markets to the extent that and even before Marine Le Pen offered a concilliatory olive branch, we were looking at some Indicators and signals coming from Apollo that might suggest some interesting investment opportunities are beginning to show themselves.

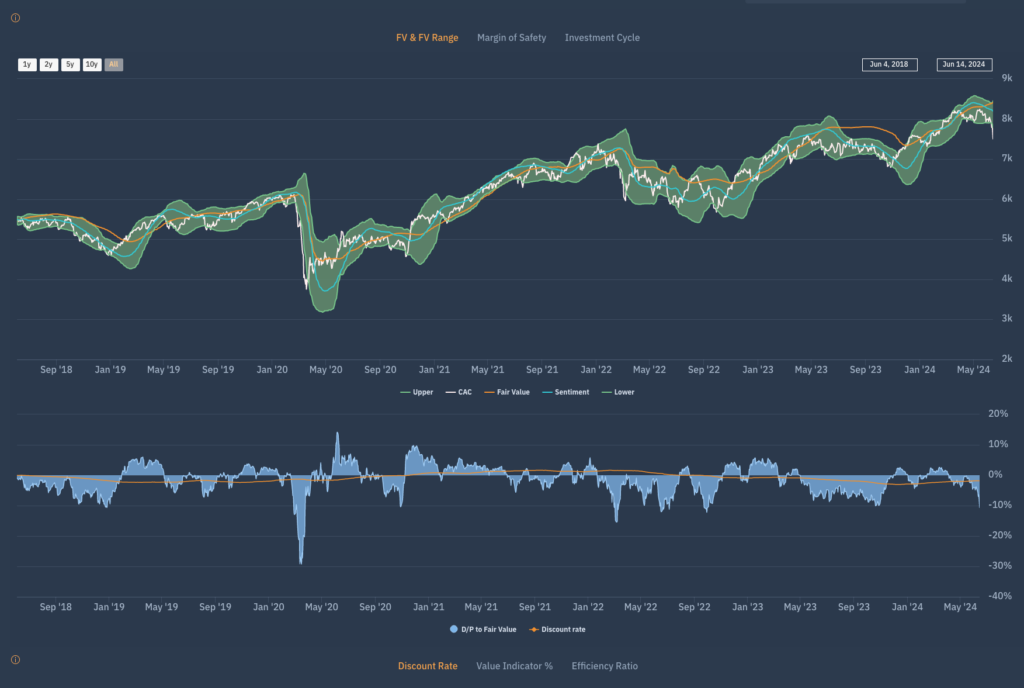

Prior to the election announcement the CAC 40 was trading nicely within its Fair Value range with limited volatility. That has now changed as risk was quickly priced in – see from the chart below. The index plummeted through the lower boundary of the FV range and the discount to FV is currently 10%.

That’s a big deal at an index level as the discount to FV chart shows (see lower chart.) Barring the Covid correction and again in March 22 we see the CAC trading at the a discount to FV that is close to a 6 year low accompanied by a positive Risk adjusted Return signal.

So at an aggregate level, we are seeing what we call, a Need to Know moment. If that’s the picture at a macro level, there are some even more significant signals at an individual stock level. Half the market is generating a positive RaR signal and a few of those are generating a positive RaR and low Risk of loss signal. A good example is Airbus (see below) but also Safran, Vinci, Bouygues and I would add Cap Gemini and Axa into this list too.

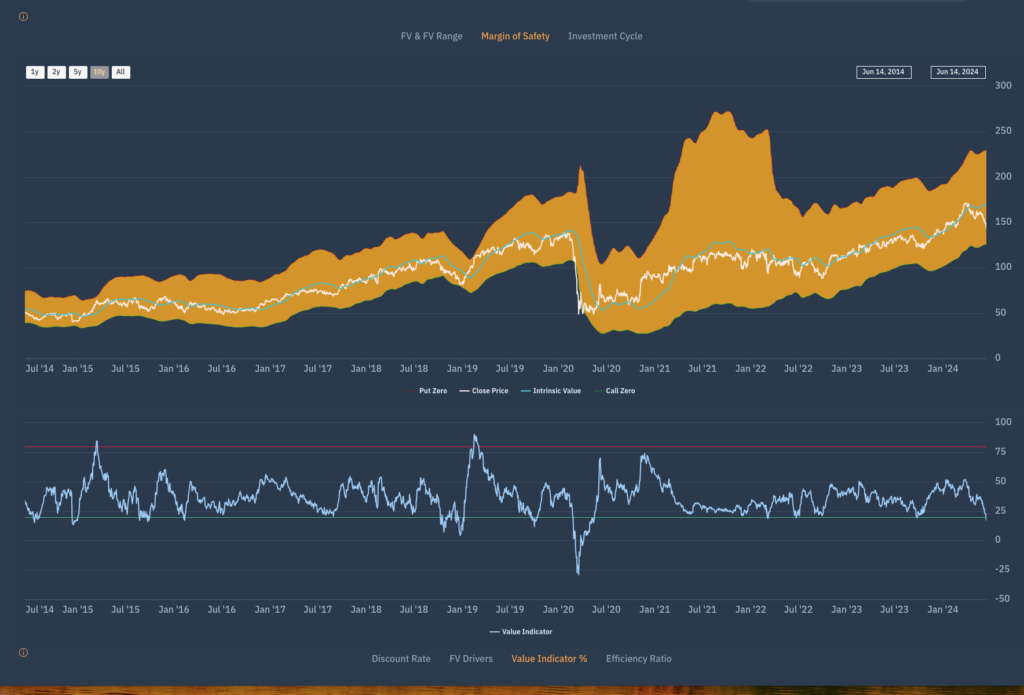

The image above is the 10 year Margin of safety chart for AIR FP and although not easy to see the top image, the lower image is the one that matter and shows the Apollo Value Indicator. We are now at a key Need to know moment of value relative to last 10 years.

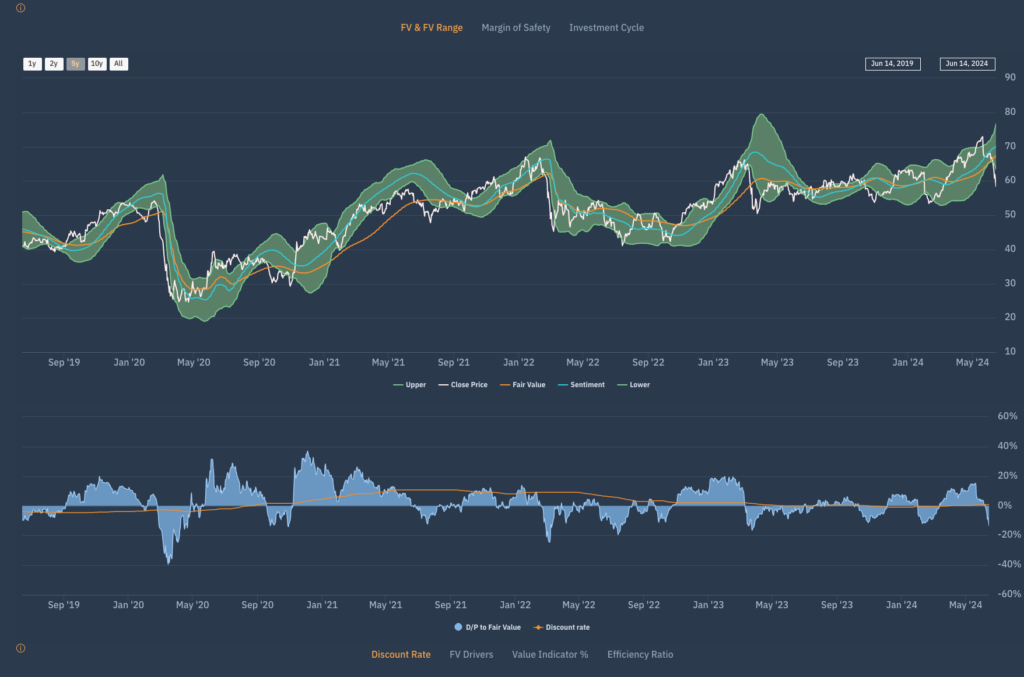

The last image is BNP Paribas – The Margin of safety once again, for the past 10 years and Credit Agricole and Societe Generale are very similar to look at. The Value Indicator score is the telling a clear story of value here.

Another way of seeing the impact of the election announcement and change is sentiment is to look at the FV range and discount / premium to FV chart one. Here you see that that BNP and its peers were trading at big premiums to FV (a point we made at the time, believing that valuations were becoming too rich) so all in all, we have seen a 20% swing in FV and so we have gone to one extreme of value to another, thus generating a positive Risk adjusted return signal – a very powerful signal suggesting a price reversal could be imminent.

In conclusion, events in France has burnt the market and investors, but at a company level, especially international companies – and particularly Aerospace and Defence value opportunities are starting to appear.