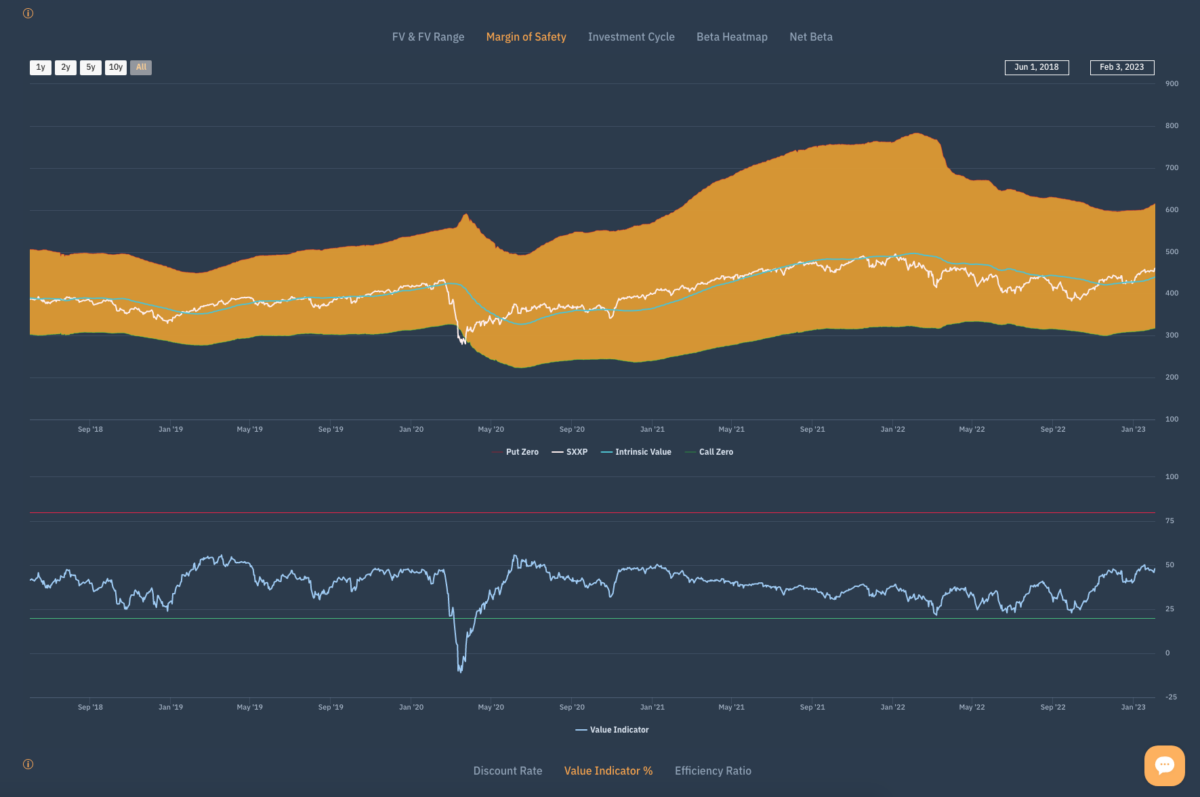

According to Edwin Starr, absolutely nothing, but shareholders of BAE Systems and other European defence stocks might beg to differ as the chart below shows.

According to Edwin Starr, absolutely nothing, but shareholders of BAE Systems and other European defence stocks might beg to differ as the chart below shows.

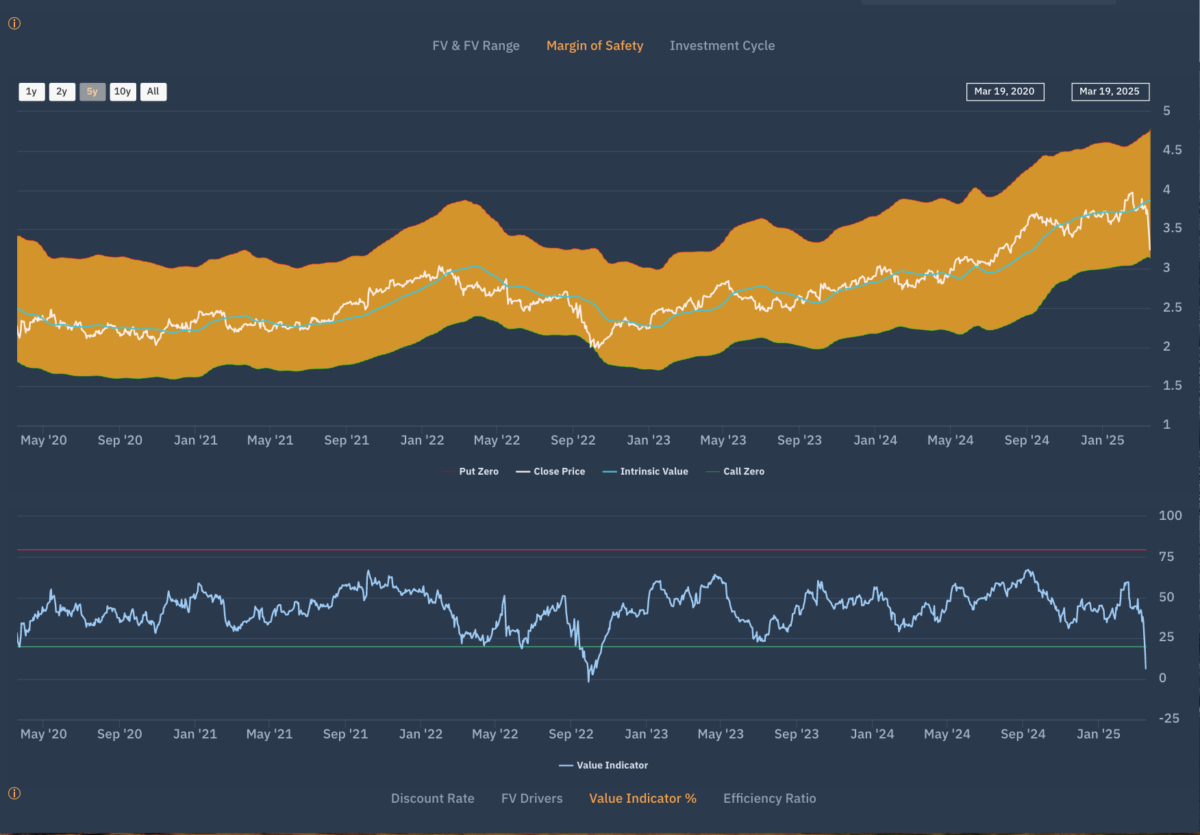

Setting up for the summer. As markets review how they survived the turmoil of the Spring, thoughts turn to summer…

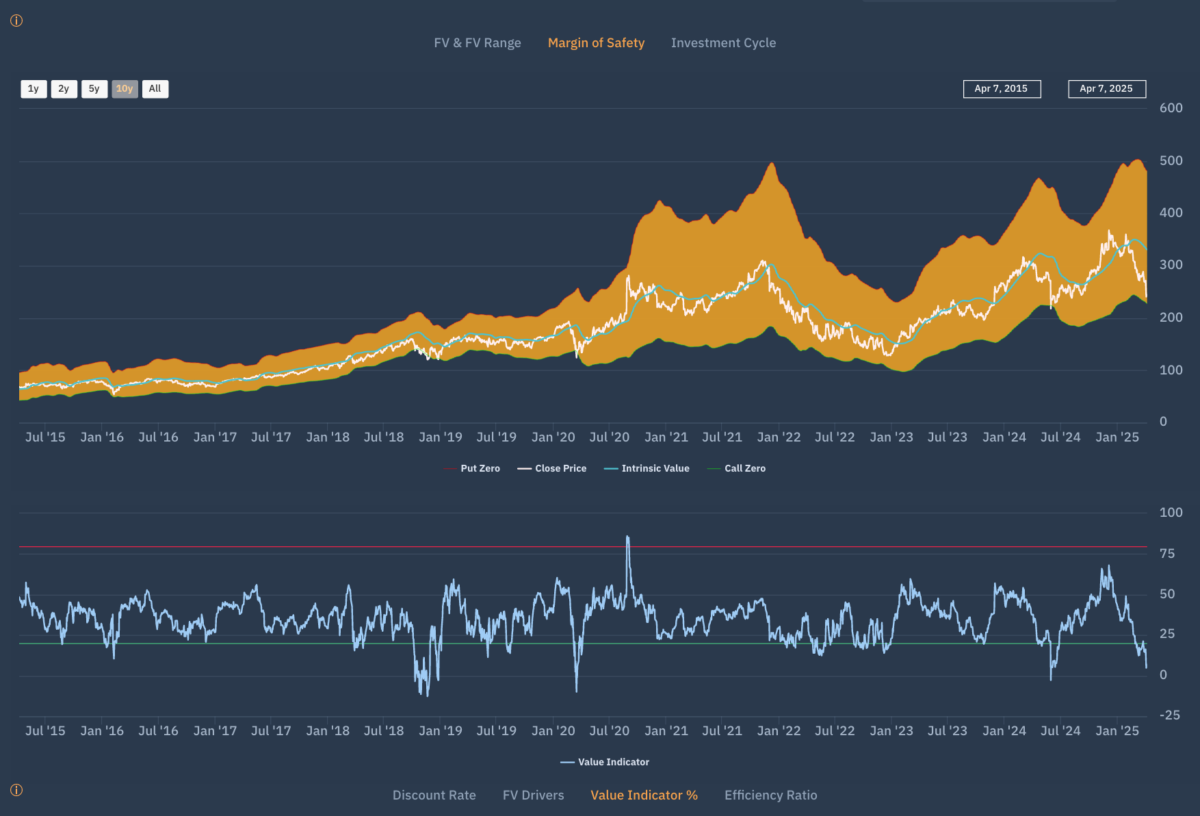

In the same way that many investment advisors failed to sell certain stocks when the time arose (see previous posts) they may not have the skillset or process that allows them gauge when to buy. In markets such as this, an answer is to be found in Benjamin Graham’s Margin of safety. The principle of […]

Knowing when to buy a stock is one thing but understanding the risk of loss is another skill altogether.

As someone who has been around long enough to be following Tesco’s stock market journey since the late 1980’s I found myself bemused by the share price reaction to the news that Asda was on the verge of announcing a price war. Over the years we have got used to price wars, particularly the threat […]

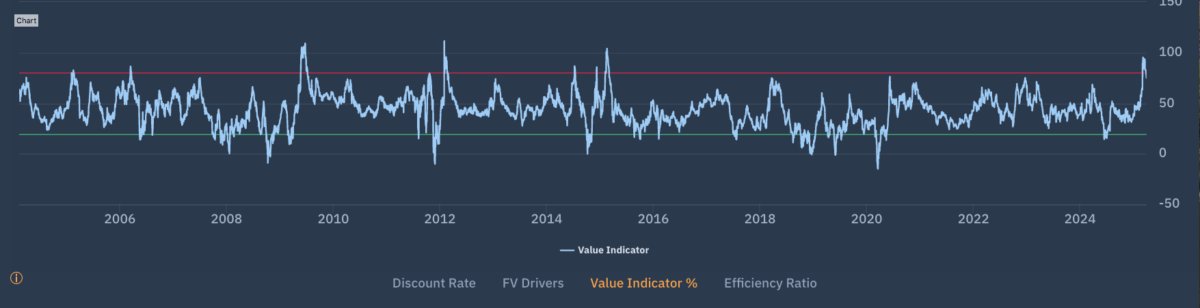

Investing is all about knowledge which is why we have always used the phrase “The Need to Know” when describing what Apollo is and does and h0w it can help investors. Apollo (through the EDGE platform) provides investors an insight which gives them that edge.

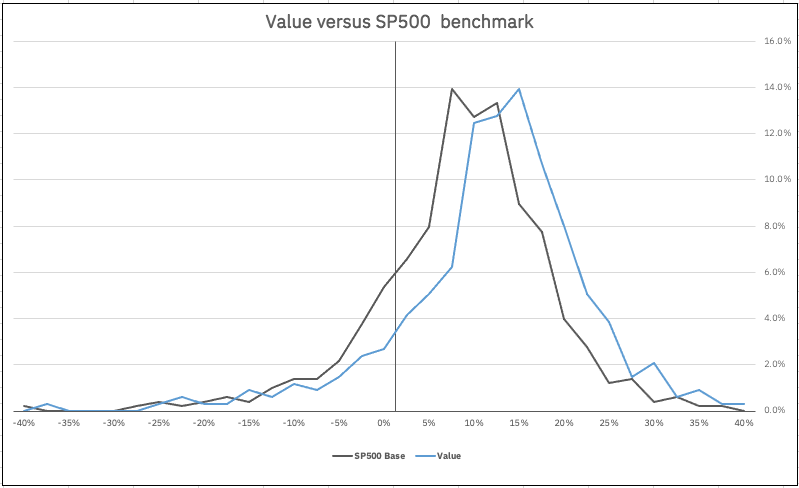

There are many reasons why our Smart Alpha process works so well and stands up to scrutiny.

We start with the investible universe and immediately ‘knock out’ the stocks we don’t want to own. Stocks are initially selected by Factor – a ‘bottom up’ selection process.

The story of this sector has been one that demonstrates perfectly the Apollo Investment Cycle as we have seen the move from Value to Re-rating and Growth. We now have a group of low volatility Re-rating and Growth stocks – otherwise known as Quality and as we look at the group today we see the majority showing Accelerator Long signals to fully support the investment case that investors have been buying into.

It’s the big calls that make the big difference to both Equity and Cross Asset investors and we’ve been doing this successfully for years.

We have recently introduced a new feature on the Apollo Edge platform that allows investors to “Smart Filter” their portfolios or watchlists at the stock level, using our proprietary investment factor groupings of Value, Re-rating, Growth or De-rating.