Entering into February, we take a look back at the weather report for January 2026 and take a view on what might lie ahead in H1.

Entering into February, we take a look back at the weather report for January 2026 and take a view on what might lie ahead in H1.

Do traditional market patterns still matter in the age of AI and the 2025 surge in retail investor flows? As we enter November, we review what Tail winds might persist into year end.

As summer ends, we move into more autumnal conditions in the markets. Things remain relatively stead but we can expect a pick up in the weather ahead as corporate reports and macro factors start to set the course to year end.

Investment decisions are not just about Risk and Return – they are aboutindentifying the risks you DO NOT NEED TO TAKE. A focus upon the least appreciated of the Rumsfeld identities _Unknown Knowns – helps to shape our perception of the investment biases we do not need to follow if we want to maximise wealth.

According to Edwin Starr, absolutely nothing, but shareholders of BAE Systems and other European defence stocks might beg to differ as the chart below shows.

Setting up for the summer. As markets review how they survived the turmoil of the Spring, thoughts turn to summer…

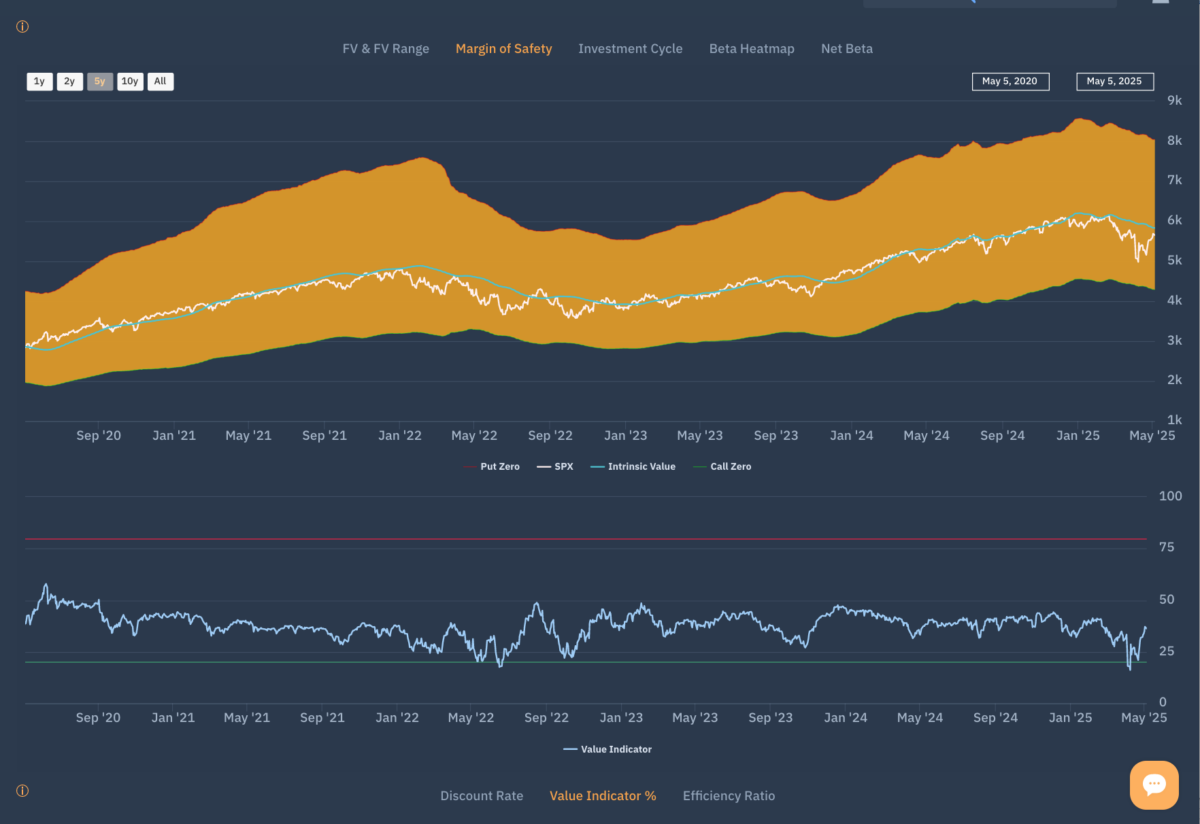

There should be a better conversation about how to manage both risk and reward in equity markets.

Reporting on what has been going on and why is one thing. Knowing what to do about it and when is another altogether.

Everything we do at Libra is from ‘the bottom up.’ The sector and market signals are an aggregation from the signal stock level. Investors can start at the market level and cascade from sectors to stocks to see the best opportunities.

As the (still ongoing) fallout from the market turmoil starts to be evaluated, there has been a natural temptation to rationalise and understand recent activity through the traditional lens of cause and effect: “… (A) market response to an (un)anticipated event occurred because Event X threatened to provoke subsequent (negative) Outcome Y and markets reacted […]