Knowing when to buy a stock is one thing but understanding the risk of loss is another skill altogether.

Fly me to the moon…

Knowing when to buy a stock is one thing but understanding the risk of loss is another skill altogether.

In May 2007 the sector traded at €200. During the GFC (Great Financial Crisis) the sector hit a low of €24 in March 2009 and from that moment until September 2023, the sector was an investor’s graveyard. In October 2022 Apollo deep value signals appeared equivalent to the GFC and Covid period. A Need to […]

As someone who has been around long enough to be following Tesco’s stock market journey since the late 1980’s I found myself bemused by the share price reaction to the news that Asda was on the verge of announcing a price war. Over the years we have got used to price wars, particularly the threat […]

Investors thought they had entered the year with complete clarity. US exceptionalism being just one of those factors. Last years winners would be this year’s winners etc. Sure, there would be change under Donald Trump’s presidency but no-one forecast what has happened and would happen and for investors, to use an excellent analogy the cockpit […]

Novo Nordisk (home to Ozempic) released results this morning have left the shares wallowing – 9.5% which now takes the shares down by -41% over the past 6 months. Those are the sort of numbers that only the Ozempic taking customers would be proud of if they applied to their waistlines. The writing has been […]

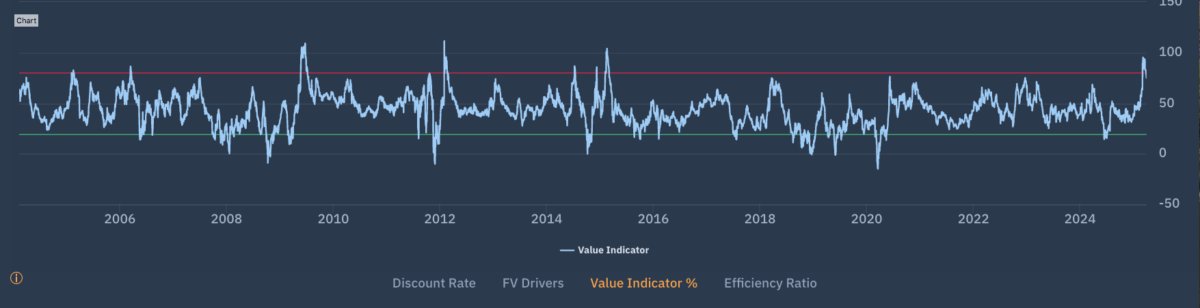

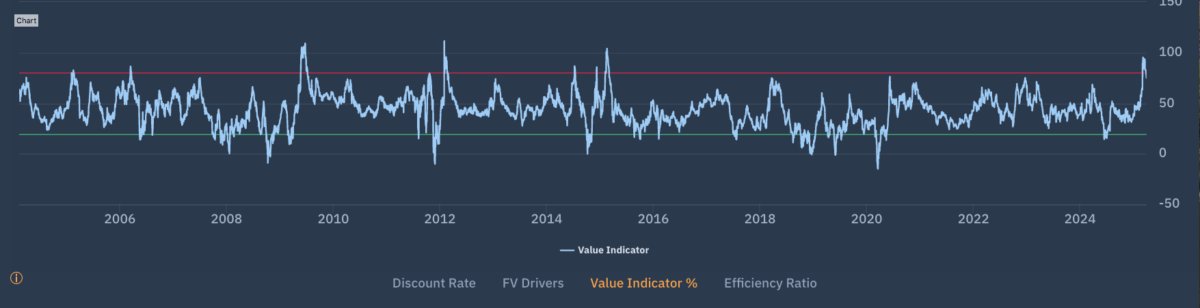

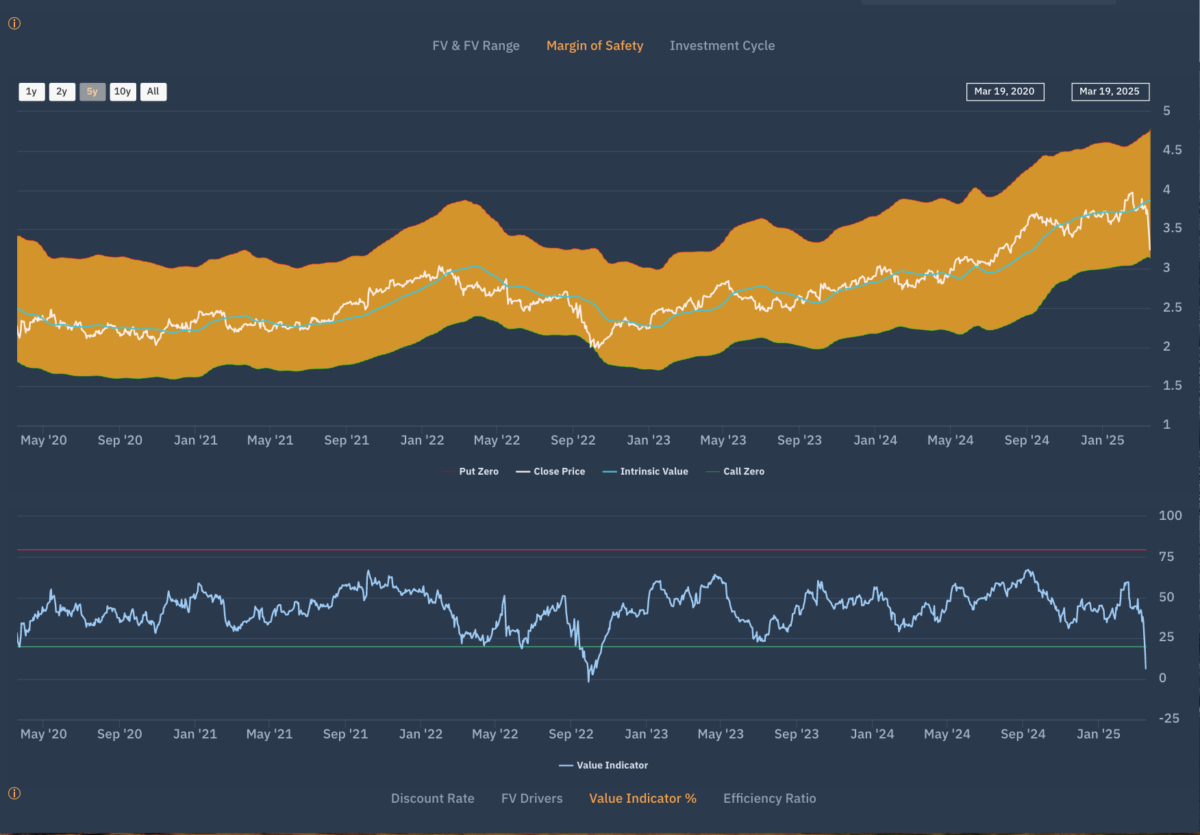

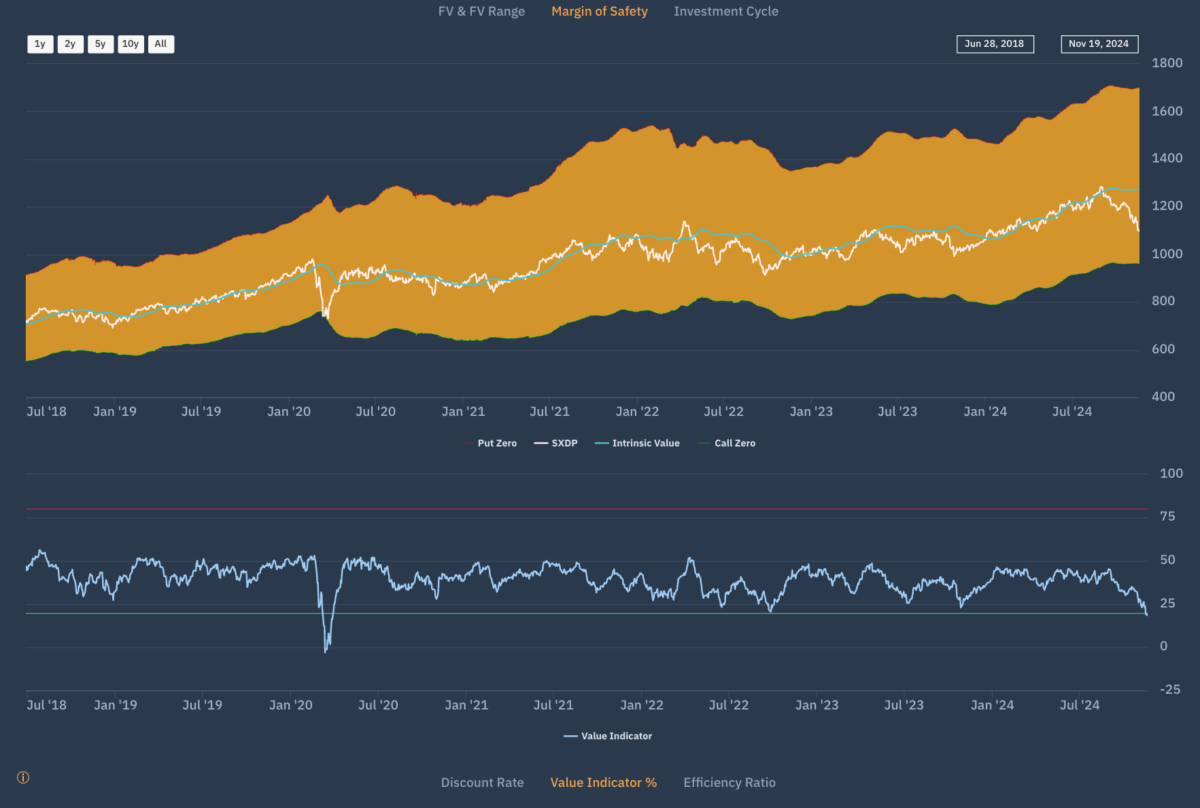

It’s been some time since I posted content from our Apollo EDGE platform but to those that follow our work, the Investment Cycle and Implied cost of capital model are key to understanding when stocks enter periods of change.In the images below you can see the Investment Cycle evolution over time. Nvidia entered a de-rating […]

A series of individual stock concerns in both the US and Europe – think Glaxo Smith Kline, Moderna, Astra Zeneca, Eli Lilly, Smith and Nephew, Merck and even Novo Norsdisk added to the fact that the new Trump administration may not be friendly for the sector has seen the sector in a Trump Slump.

Investing is all about knowledge which is why we have always used the phrase “The Need to Know” when describing what Apollo is and does and h0w it can help investors. Apollo (through the EDGE platform) provides investors an insight which gives them that edge.

President Macron’s decision to call a snap election has had a dramatic effect on bond and equity markets to the extent that and even before Marine Le Pen offered a concilliatory olive branch, we were looking at some Indicators and signals coming from Apollo that might suggest some interesting investment opportunities are beginning to show […]

There are many reasons why our Smart Alpha process works so well and stands up to scrutiny.

We start with the investible universe and immediately ‘knock out’ the stocks we don’t want to own. Stocks are initially selected by Factor – a ‘bottom up’ selection process.