In the world of data – quality is everything. We have now made Apollo data even more accessible and user friendly as the whole database can now be delivered seamlessly to your workflows via Snowflake – a data warehouse built for the cloud.

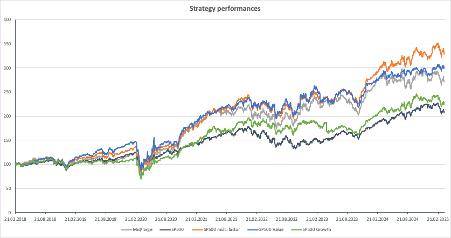

Everything we do at Libra is from ‘the bottom up.’ The sector and market signals are an aggregation from the signal stock level. Investors can start at the market level and cascade from sectors to stocks to see the best opportunities.

Am I hallucinating?

As the (still ongoing) fallout from the market turmoil starts to be evaluated, there has been a natural temptation to rationalise and understand recent activity through the traditional lens of cause and effect: “… (A) market response to an (un)anticipated event occurred because Event X threatened to provoke subsequent (negative) Outcome Y and markets reacted […]

The Weather Forecast : Q2 2025

Welcome to the Weather Forecast

As we continue to roll out our Smart Alpha strategies, we are publishing a regular newsletter – the Weather forecast that looks at how Smart Alpha strategies can help navigate the current investment climate.

The team here at Libra Investment Services have been analysing global economies and markets for the best part of 40 years and, over that time have seen how the interaction of macro and micro trends, stock level financials and thematic and sector dynamics influence and, ultimately, drive the complex adaptive system that is the financial market. […]

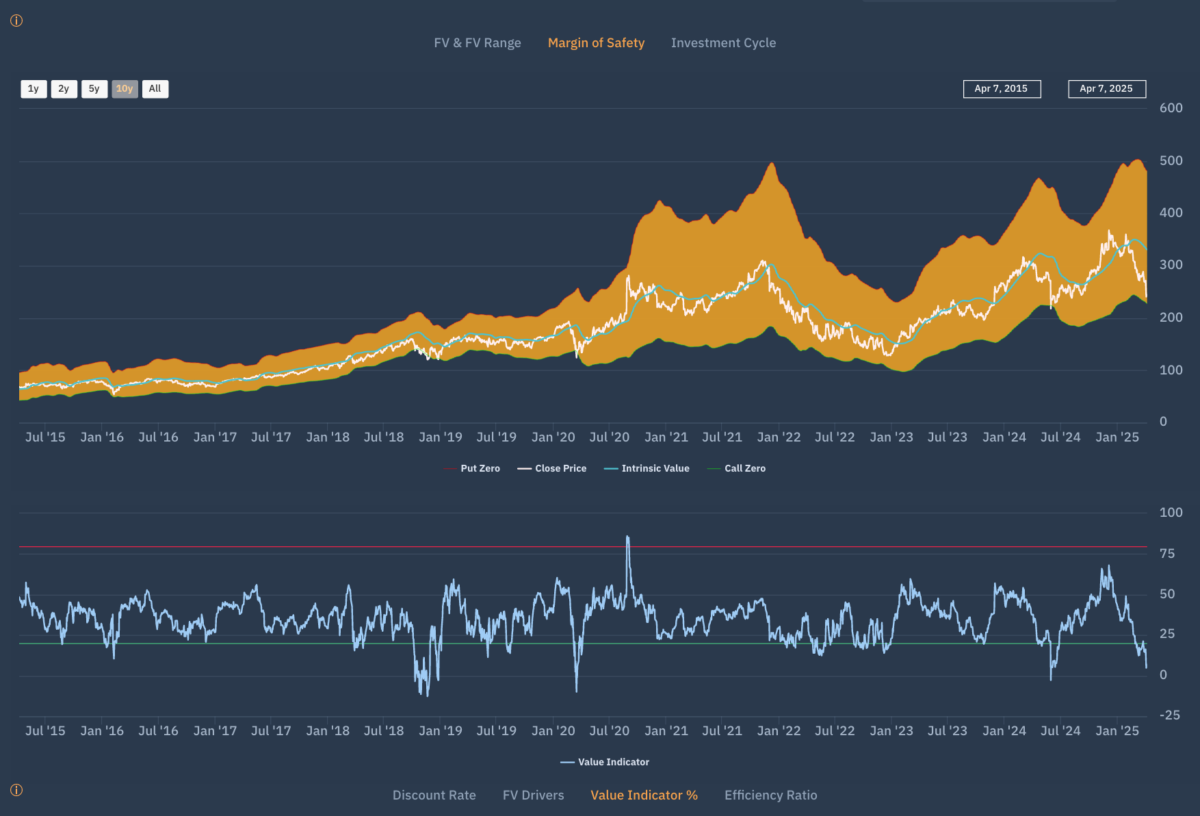

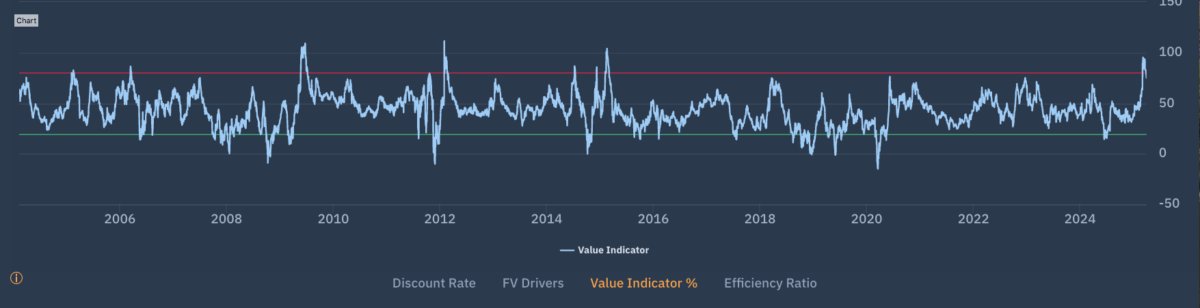

In the same way that many investment advisors failed to sell certain stocks when the time arose (see previous posts) they may not have the skillset or process that allows them gauge when to buy. In markets such as this, an answer is to be found in Benjamin Graham’s Margin of safety. The principle of […]

Fly me to the moon…

Knowing when to buy a stock is one thing but understanding the risk of loss is another skill altogether.

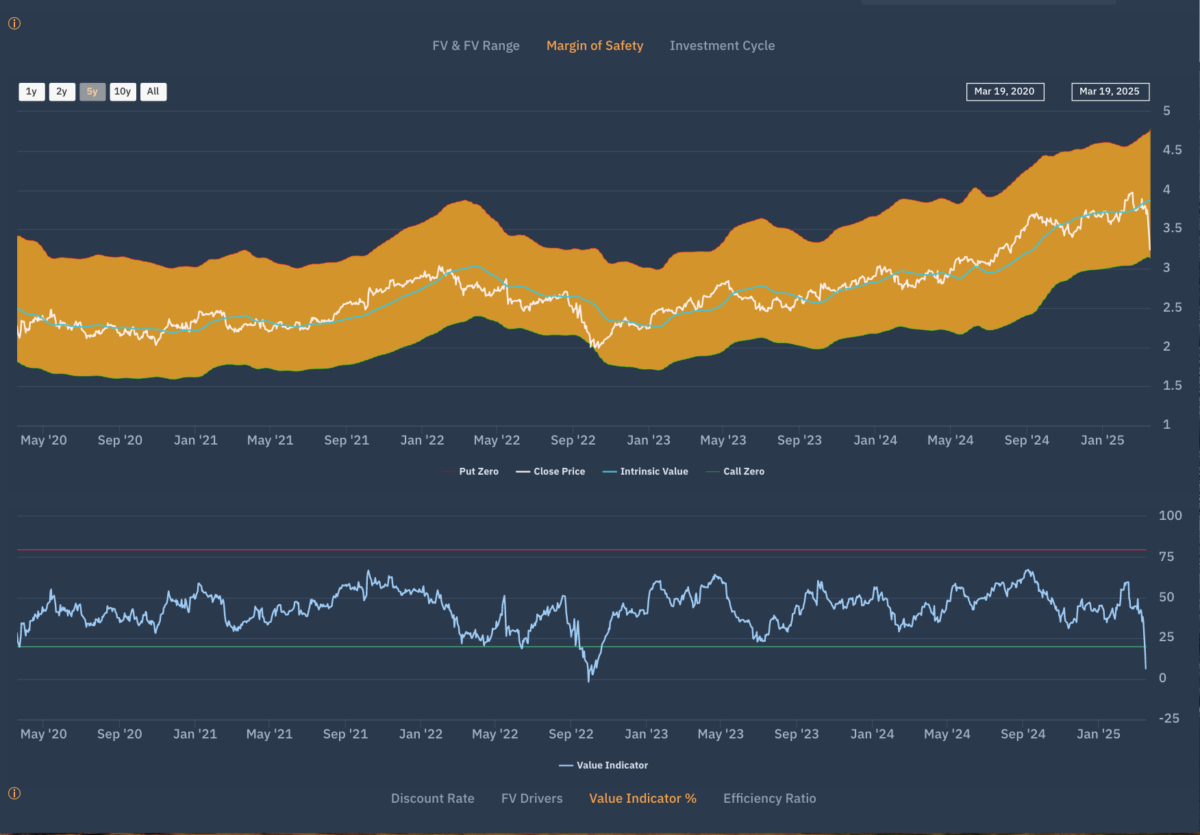

Euro banks are in the red

In May 2007 the sector traded at €200. During the GFC (Great Financial Crisis) the sector hit a low of €24 in March 2009 and from that moment until September 2023, the sector was an investor’s graveyard. In October 2022 Apollo deep value signals appeared equivalent to the GFC and Covid period. A Need to […]

As someone who has been around long enough to be following Tesco’s stock market journey since the late 1980’s I found myself bemused by the share price reaction to the news that Asda was on the verge of announcing a price war. Over the years we have got used to price wars, particularly the threat […]

Investors thought they had entered the year with complete clarity. US exceptionalism being just one of those factors. Last years winners would be this year’s winners etc. Sure, there would be change under Donald Trump’s presidency but no-one forecast what has happened and would happen and for investors, to use an excellent analogy the cockpit […]