As global equity markets look ahead to the coming year, we summarise the year that has gone and look forward to the New Horizons of 2026 through the lens of Apollo.

As global equity markets look ahead to the coming year, we summarise the year that has gone and look forward to the New Horizons of 2026 through the lens of Apollo.

Catfish season… We call our regular Apollo based commentary “The Weather report”. The analogies that we can make with the multiple elements of Value, Momentum and Uncertainty impacting markets in a continuous way chimes nicely with the idea of Currents, Tides and Winds, all impacting the navigation of the high seas. Whatever the nature of the vessel […]

One reason that we call this report “The Weather report” is that the analogies with multiple elements of Value, Momentum and Uncertainty impacting markets in a continuous way chimes with the idea of Currents, Tides and Winds, all impacting the navigation of the high seas. Whatever the nature of the vessel concerned or the skills, experience […]

Entering into February, we take a look back at the weather report for January 2026 and take a view on what might lie ahead in H1.

Knowing the when the where and the how is a powerful tool within the investment armoury.

The Apollo momentum signal is a measure of the momentum associated with inter-temporal changes in stock level expected returns and the consequent re-estimation of future expected returns by the market. We refer to this as the (momentum) accelerator signal. The image shows the Accelerator (long) signal as seen on the Broadcom – this is one […]

Do traditional market patterns still matter in the age of AI and the 2025 surge in retail investor flows? As we enter November, we review what Tail winds might persist into year end.

The Need to Know – Always Since we created Apollo – 20+ years ago, we have come up with one of two great ‘strap lines’ for what we do and ‘The Need to Know’ was one of them on the basis that once you know, you know. You see, you understand and make a decision […]

Storm season arrives We call our regular Apollo based commentary “The Weather report”. The analogies that we can make with the multiple elements of Value, Momentum and Uncertainty impacting markets in a continuous way chimes nicely with the idea of Currents, Tides and Winds, all impacting the navigation of the high seas. Whatever the nature of […]

As summer ends, we move into more autumnal conditions in the markets. Things remain relatively stead but we can expect a pick up in the weather ahead as corporate reports and macro factors start to set the course to year end.

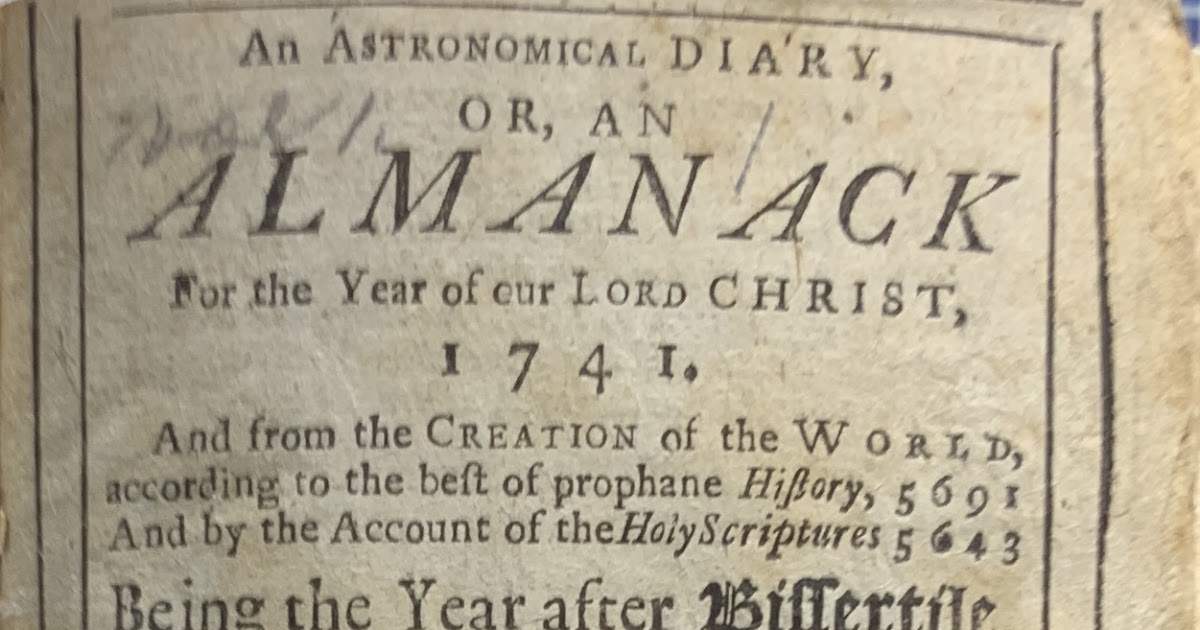

Beyond the weather report, the other essential maritime document is the Nautical Almanac. In many ways, a form of Market Almanac could be a useful addition to the information system for investors and the following document is a version of it, based upon the Apollo view of the markets.