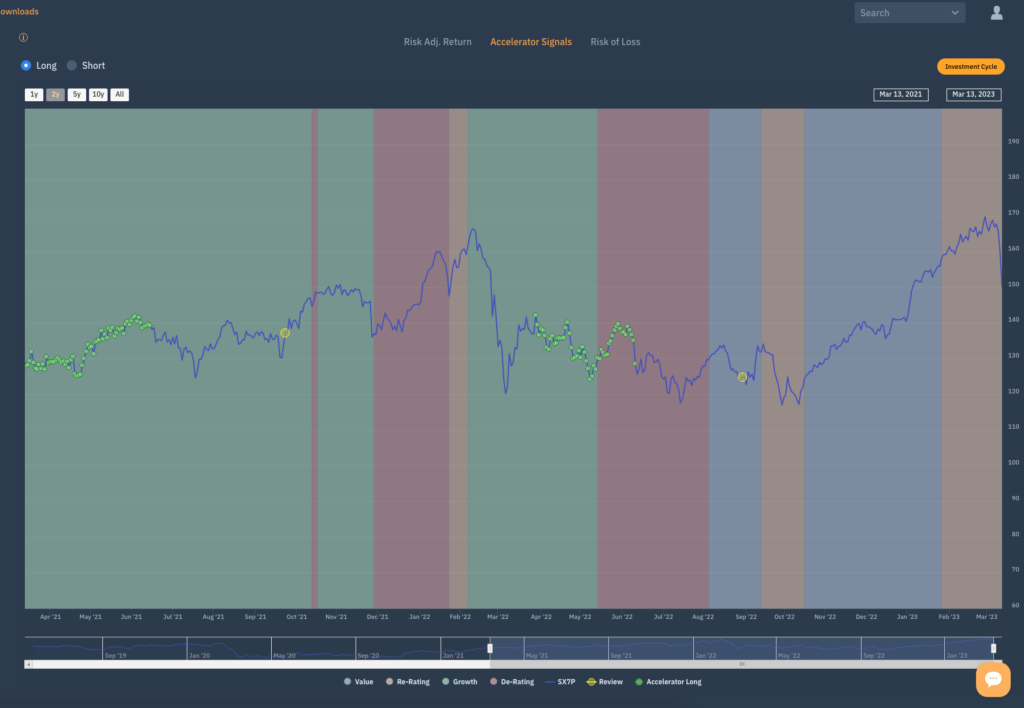

In a previous blog comment – Banking On It – we highlighted the renaissance of the European Banking sector over the past 10 months. A renaissance that began with the emergence of the Accelerator Long signals / Growth signals in the summer of 2022 when the sector was still in the Value phase of the Investment Cycle which then morphed into a period of re-rating and into the Growth Cycle as investors saw a blue skies on the horizon. The chart below shows that Accelerator Long signal in the summer of ’22 followed by the evolution of the Investment Cycle.

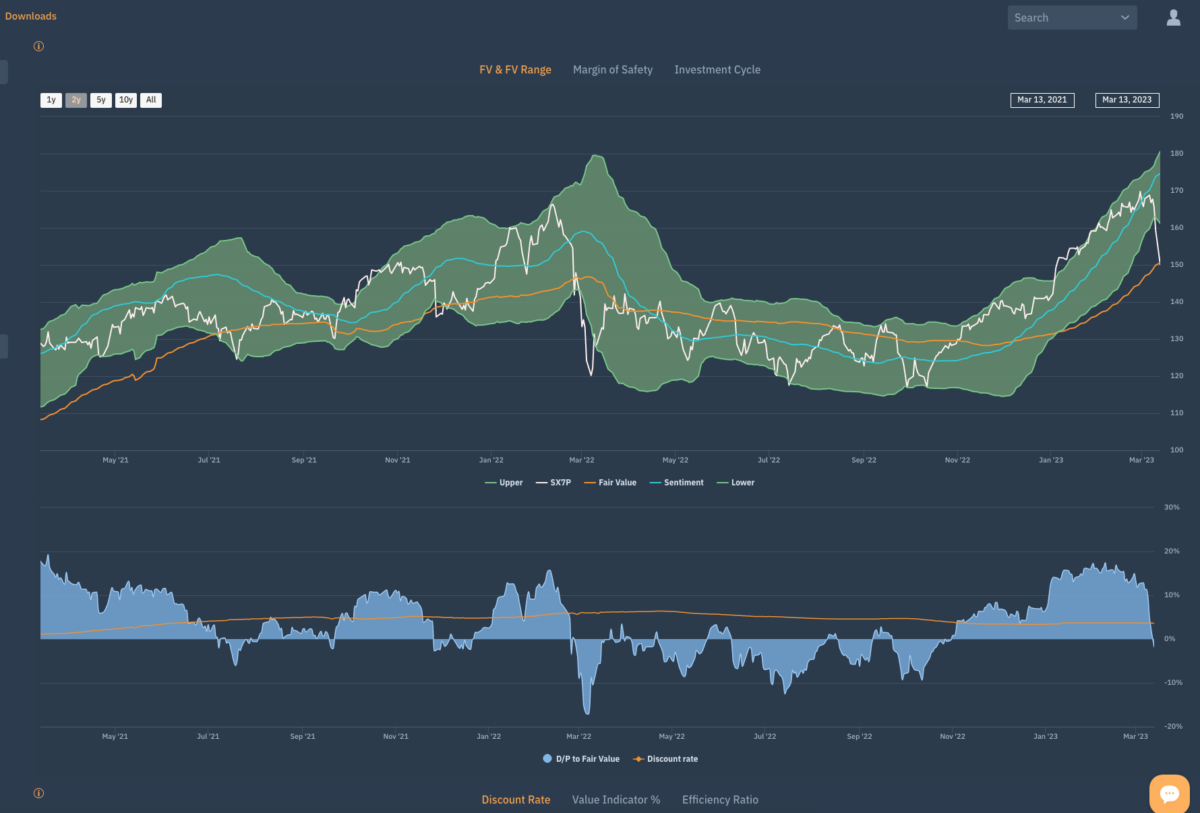

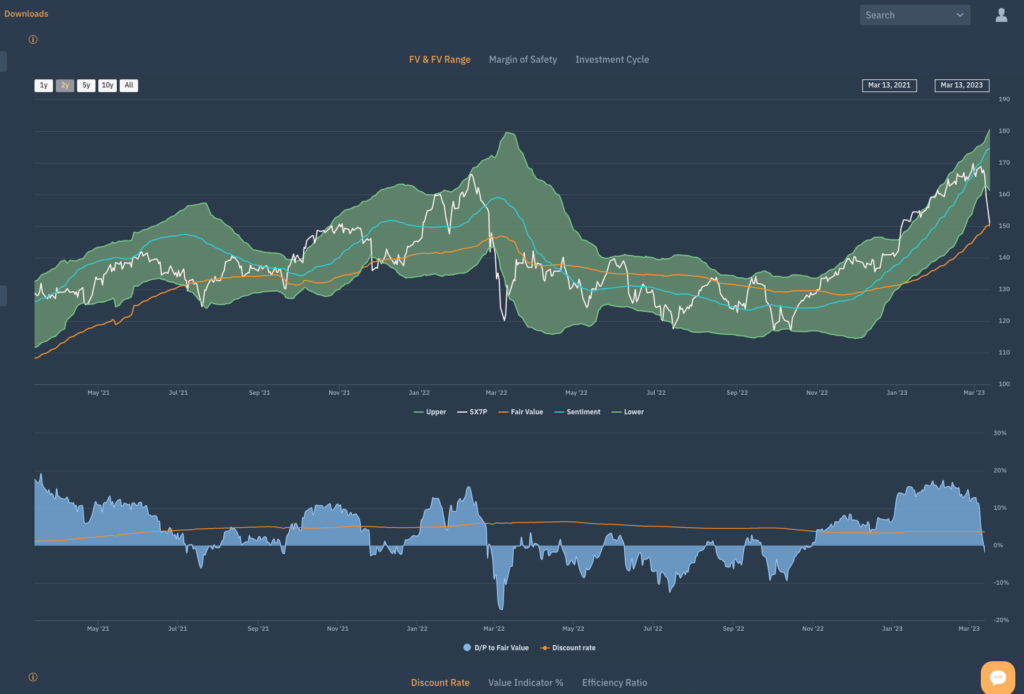

Investors universally bought into the sector – value trends were rising and volatility fell. The sector reached a point where the SX7P was trading at a 20% premium to FV. As high as it has been since the GFC which brings us to the chart below which shows the FV range of the FV range of the European Banks sector – a measure of upside / downside expectations based on the volatility of the share price around FV – the orange line and below that – an image that shows the premium / discount to FV.

The chart is relevant for any investor – the premium to FV is notable as already mentioned and reflects all the optimism and expectation that should and did act as a warning sign.

The consequence of recent events (SVB) meant that the market had to reconsider the discount rate being applied to future cash and the repricing meant the sector has come back to the Orange line – FV. A moment that we call ‘back to value’ – zero premium to present value so surely an opportunity to buy?

The fact that the Index has fallen below the lower boundary of the FV range is a concern on the one hand – reflecting the negativity around sentiment although others with a more optimistic take might also say the baby has been thrown out with the bath water.

Either way, this is a Need To Know Moment.