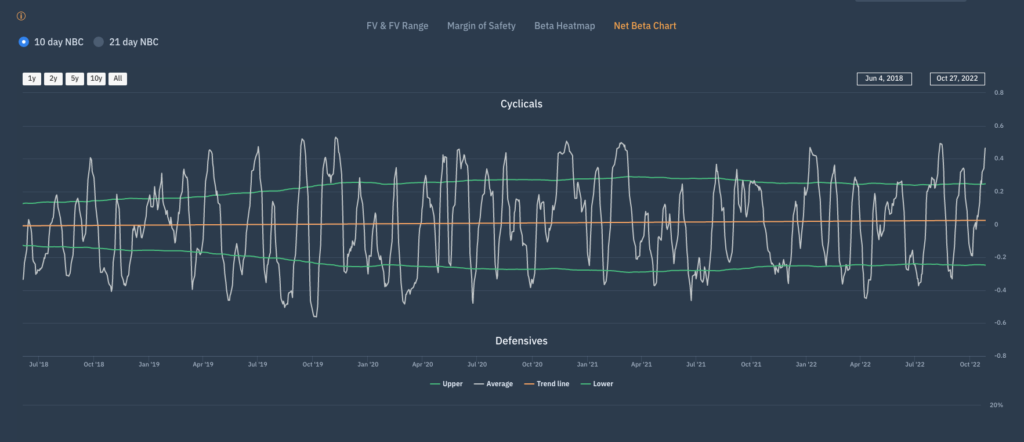

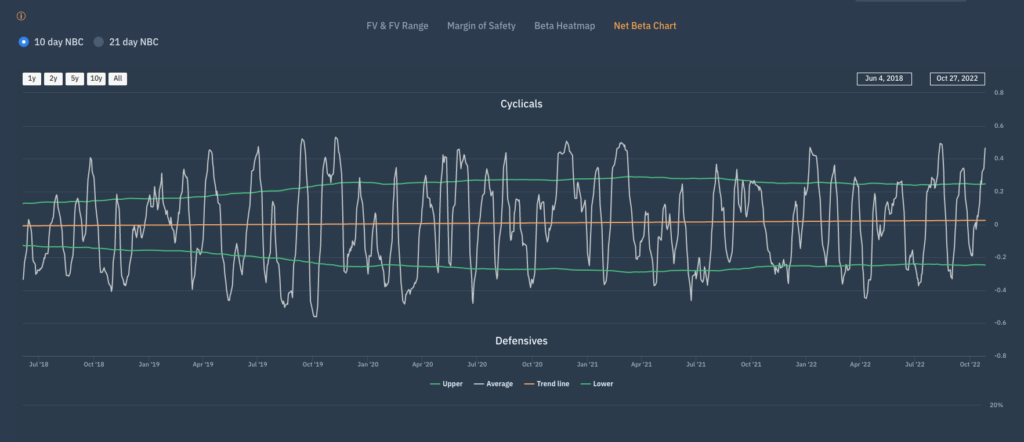

A look at the beta heat map and net beta chart shows only too well the extent of the rotation into higher beta / cyclical sectors lately. The move is now at an extreme relative to anything seen over the past 5 years and on that basis a rotation the other way should be in order and there is justification for that reversal for two reasons associated with the Apollo process.

The first is that the rally has seen these cyclical sectors move back to FV and those FV trends are not rising and neither are the FV ranges, so in most cases these sectors are now trading near the upper boundary of those ranges.

The second reason to suggest that we will see an end to this high beta rally is that all these sectors are generating the Accelerator short signal. Prior to this rally these sectors were (and continue to be) in a Value regime and as we said a few weeks ago, when there is a change in sentiment / rotation the likelihood of significant share price moves to the upside under these circumstances is strong. However, as we also pointed out in the recent blog (‘From 0.4% to 4.0%’) when the momentum of expected returns is downward and the ICC being applied by the market is still rising, as it is in all cases, that rally will prove unsustainable.

As for the rotation into lower beta sectors, this could be there time as these too are in the Value basket – they trade at towards the lower boundary of their FV ranges and at significant discounts to FV. Do they look attractive investment opportunities? No. Barring Telecoms all have the Accelerators short signal but one can make a case for the move at this time.

2 replies on “Nowhere to run to nowhere to hide”

Looks interesting but the article does not explain Accelerator signal so I’m a bit lost. Would be nice to see some statistical analysis of the beta signal. Charts are great but even over 5 years they can be deceiving.

Hi Steve,

Thanks for the query. Rob’s comment ties into the Apollo range of analytics products and signals that we’ve developed at Libra Investment Services – one of which – the accelerator signal – is a proprietary measure of fundamental momentum. As you can see, this is a brand new blog and I plan to write a series of explanatory blogs over the coming weeks providing just that sort of study and explanation but in the meantime I wrote about this signal in detail in a Wiley publication from 2020: “Market Momentum Theory and practice” – by Satchell and Grant if you want to get the full academic backdrop on it. Otherwise, drop me a line and I am happy to chat.