As the (still ongoing) fallout from the market turmoil starts to be evaluated, there has been a natural temptation to rationalise and understand recent activity through the traditional lens of cause and effect: “… (A) market response to an (un)anticipated event occurred because Event X threatened to provoke subsequent (negative) Outcome Y and markets reacted […]

Tag: Complex adaptive systems

The Weather Forecast : Q2 2025

Welcome to the Weather Forecast

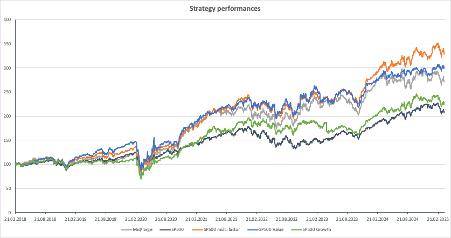

As we continue to roll out our Smart Alpha strategies, we are publishing a regular newsletter – the Weather forecast that looks at how Smart Alpha strategies can help navigate the current investment climate.

The team here at Libra Investment Services have been analysing global economies and markets for the best part of 40 years and, over that time have seen how the interaction of macro and micro trends, stock level financials and thematic and sector dynamics influence and, ultimately, drive the complex adaptive system that is the financial market. […]

Sprinting for Lent

As we start a new Smart Alpha “Sprint period” for out S&P500 based Strategy, it is worth reviewing how we have performed so far this year.

Original thinking, essential insight.

Libra Investment Services has spent the last twelve years operating as a research and advisory business to equity market investors worldwide. At the heart of our approach is the idea that equity markets are not a complicated problem to simplify and solve but instead are an open, complex adaptive system to be analysed and understood as much as we can; regardless of their current state of uncertainty or unpredictability.