The team at Libra Investment Services have been analysing global economies and markets for the best part of 40 years and, over that time have seen how the interaction of macro and micro trends, stock level financials and thematic and sector dynamics influence and, ultimately, drive the complex adaptive system that is the financial market. Our key resource is a proprietary analytical framework, Apollo, that uses Machine Learning and neural network techniques to systematically analyse and forecast individual companies; their expected returns and associated probabilities that allows us to aggregate and build our world view from the bottom up. If you are interested in learning more we have set out this backdrop as an aide memoire for those occasional readers of our commentaries and postings on markets and strategies and as a source of reference for those interested in a little more detail as to how our proprietary data and models allow us to make the systematic calls and recommendations that are associated with the Apollo system.

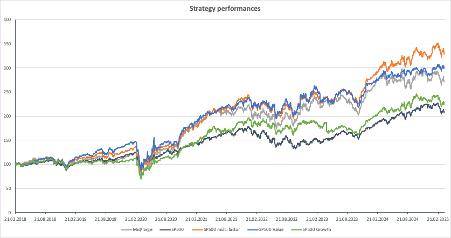

One of the results of having this process is that we are able to use its data outputs to generate our Smart Alpha portfolio models that generate a set of strategies for systematic, global equity market investing. A number of these Smart Alpha Strategies are available as active indices for licencing and execution via BX Index and with these strategies in mind, we provide our latest thoughts below:

The Weather Forecast

Much of what we are able to do in investment comes from selecting assets that match the current outlook for positive returns where possible and with a higher-than-average of probability of coming true. Not every quarter can deliver 20%+ annualised returns but it doesn’t seem unreasonable to at least target a 4.75% asset return over a three-month time frame at the outset of the period, where the valuation or earnings story might support it. As a result, our review of the first quarter of 2025 looks at not only what we were able to observe after the close out of the quarter but where those annualised forecast return expectations (and their associated probabilities) are pointing. By taking a view on the outlook as well as the degree to which the level of negativity in recent weeks may be over-estimating the longer-term downsides (we calculate a Margin of Safety measure for every stock) we can construct not only a “Q1 2025 Weather Report” but a “Q2 2025 Weather Forecast” for the market.

So how did Smart Alpha perform in Q1?

An awful lot has been written about the US stock market performance in the first quarter of 2025 with the decline in not only the headline SP500 but Tech sector stocks in particular and from a thematic point of view the changing landscape with respect to AI. This has shifted the focus to not just short-term pain trades but to the prospect for equity market returns – and the increased uncertainty related to those returns – for the rest of 2025.

Across the range of US based strategies covered by Smart Alpha, the impact of the Tech sector sell off was evident in the decline in the US innovation portfolio – a drop of (-12.5%) versus the benchmark NASDAQ 100 of (-8.25%). By contrast, the Smart Alpha factor universes: Value (+5.3%), Growth (-2.5%), long only multifactor large Cap (+2.8%) and long only mid/large Cap (-1.3%) all outperformed the SP500 (-4.6%). The relative decline in mega caps since mid-February helps to explain the underperformance of the SP500 versus its equal weighted counterpart (-4.6% vs -1.1%) but the (-6.5%) decline in the SP400 mid-cap benchmark suggests that there was clearly an alpha positive story in terms of stock selection across all the market based, Smart Alpha portfolios. As much as the tracker and passive funds might want to suggest to the contrary, stock stories – both individually and collectively continued to shape portfolio returns in Q1 and beyond.

So much for that…

The current focus upon “Liberation Day” and the US trade tariffs has been variously articulated as a “one-off phenomenon” relating to the macroeconomic shock to global trade, a geopolitical regime change and the “end of Pax America”, a “global Trade war” and a broad-based de-dollarisation of global US$ based financial assets (other interpretations of recent events are also available). However, whichever lens one seeks to view things through, the end result has been to only extend the degree of uncertainty already evidenced by the thematic and sector shifts in Q1 to the broader market.

The VIX has spiked dramatically over the first few days of April (it has gone up 127% in the last month) and remains elevated, but it was already rising into quarter end; moving through the 20 level that marks “a state of anxiety” for traders. The scale of the initial equity market sell-off and it’s broadening out to wider market conditions has had the effect of swamping everything else in terms of news flow but given the emergence of the increased uncertainty relating to this market shock, it remains important to understand not only what was and wasn’t working in the run up to April 2 2025 but to see recent events in context.

What we have seen is not in the markets is (arguably) not so much a macro shock (despite the news headlines) but a dramatic risk management shock that has been compounded by leverage and illiquidity in the Equity markets and beyond. Benchmarks are now negative for the year to a degree that we have not seen since the COVID lockdown, but it is far more of a financial market phenomenon than might be obvious at first sight. Margin calls on leveraged longs will have triggered serious pain (a 3x leveraged SP500 long trade will be down 33% over the last two weeks but 25% in the last few days) so a fair amount of current headlines will be a function of risk managers deleveraging their traders books in the face of massive volatility spikes.

The degree of pain now being experienced in the bond markets (which may well be a function of the basis-point trade blowing up) helps reinforce our view that this is about the market structure and risk management as much as it is about global demand or growth. Whether the Fed or other central banks will need to bail out those most exposed to the consequences of the mismatch between risk exposure and risk management remains to be seen, but for investors that need to evaluate their own approach to the market in the coming weeks, there are a few things to ponder.

The magic of 3 and 5-year rolls

Do you remember the last war? Current events have led us to draw just such comparisons from five years ago when the market had a meltdown over the COVID lockdown. Then (as possibly now?) the basis-point trade had threatened to blow up the markets, ZIRP returned and, as lockdown unwound, fiscal policy expansion followed. The equity market response saw dramatic initial drawdowns (the parallels to which are all over the “evening news” at the moment) followed by a strong stimulative recovery that ultimately led to back-to-back 20%+ years for the S&P500 – alongside a monetary squeeze and Ukrainian war induced 2022 slump.

The reality that this leaves us with is that, despite what has been a poor start to 2025, those relying on 3 and 5-year performance records are going to see lower past volatility and higher realised performance as the baseline rolls past the lows of March 2020 and February/March 2022 time stamped into their records. This may explain the risk reduction that many investors were undertaking into quarter end prior to the Liberation-day rout, and it is worth monitoring the fact that those who were able to lock in those multi-year return rankings by moving to cash and gold at the end of Q1 will look like investment geniuses on the marketing manifestos a year or so from now – even if the avoidance of the Tariffs was not even under consideration at the time.

Why is this important? The focus of investment should always be about repeatability of returns and the compounding nature of them. A one – three – or five -year annualised return is a valuable metric to evaluate any manager with, but in circumstances such as this, understanding the context of the market backdrop remains crucial. The 20%+ SP500 return on 2023 was impressive – but it only returned the index level to its December 31, 2021, level. Similarly, the 20%+ performance in 2024 has been wiped out by recent moves such that the SP500 is basically back to the levels of 12-months ago. (A glance at the performance of our compounding multi-factor returns portfolio (orange line) shows how important compounding becomes over time).

This extends to the AI thematic too. Just over a year ago the market took the idea of the Mag 7 to its heart. The performance of the seven big tech names had blown the market away in 2023 with outstanding performances by both Tesla (+102%) and NVDIA (+239%) driving the AI growth narrative further. The fact that the same group of stocks had underperformed the market fall in 2022 (-40% vs -19%) should not be lost on those currently looking at the rollercoaster of returns we have seen from this group so far in 2025. Yet the truth is that, after the declines of the last 2 months or so an equal weighted Mag 7 basket is -28% from its 2025 highs – but actually “only” back to August 2024 levels and still up 5% on a year ago.

The fact that the SP500 (20% capped) Technology sector ETF is down (-6.4%) over 12-months reflects the difference that the market capped weighting compared to an equal weighting has had on returns is a focus for another day, but suffice to say relative weightings do matter when it comes to risk management of expected returns, and even those who argue for passive expected return management should perhaps consider whether risk management should continue to be so passive (tracking) in nature.

What’s next?

So, what can we say about the quarter ahead? Tricky! Having drafted this piece last week (ahead of quarter-end) it has already been updated and reformatted almost daily so far this month! Uncertainty remains crippling for investors at this point so it would be easy to leave this in the draft folder for another day, but “publish and be dammed…” is today’s mantra. Given that decision, a few points to retain in what promises to be a very uncertain period.

Despite the headlines of pension fund “wipeouts” and crashing economies, the core of most investor portfolios remains positive over all historic time frames beyond the last 12 months. Not great, I grant you, but against a backdrop of widespread calls of an overvalued market in 2024, a focus verging on paranoia about the overconcentration of risk in the Mag-7 stocks and the uncomfortable reality of US stocks accounting for over 70% of global indices, this correction has been treated as some form of “out of the blue, unpredicted and unmanageable event that will destroy the global economy. Spoiler alert: it wasn’t and it won’t.

The bigger risks out there now are going to be related to the plumbing of the financial system (particularly in the US credit and derivatives markets) holding up as risk managers panic adjust their exposures to newly printed risk data points and review how well or badly their AI driven sentiment signals have performed given the spoofed good news/bad news stories “fake news!” postings of recent days. Geopolitically, my sense is that it is the Middle East that is likely to provide more sleepless nights than elsewhere in Q2, so risk management with regard to this will remain of paramount concern ; possibly limiting any further pressures on “de-dollarisation” for now.

For equity investors, as bond yields rise again, holding non-equity holdings (beyond cash) as part of a multi strategy portfolio has been shown, once again, to not perform the risk hedging diversification “promised on the tin”. This is mostly because the real risk that needed to be managed – tail risk stemming from illiquidity and leverage risk in the equity market itself – is never going to be diversified via holding credit, bonds or alternatives.

For equity investors who were not able to hedge this risk, things have been painful but (absent active exposure to illiquidity or leverage itself) not hopefully disastrous; providing sensible levels of factor and stock level diversification was pursued. So despite the current headlines, the job of the next few weeks is going to be about reviewing current holdings and themes and rebalancing, and stock picking for the “new reality” of liberation day plus.

On that note, this time next week we will be rebalancing our Smart Alpha strategies to identify the 2-month rolling forward stock opportunities and factor rankings that our Smart Alpha models throw up across our 8000 stock universe, but details of that – and a few ideas about how to actually risk manage that tail risk -are topics for a follow up piece.